Accruals : Enhancing Exchange Rate Accuracy

Redefining Accrual Reversal Processes for Precision and Compliance

As businesses navigate the complexities of global finance, ensuring accurate and transparent reporting of exchange rate impacts is crucial. This initiative aims to transform the accrual reversal process, addressing inconsistencies in exchange rate variances and aligning with international accounting standards.

The Challenge

Current Process

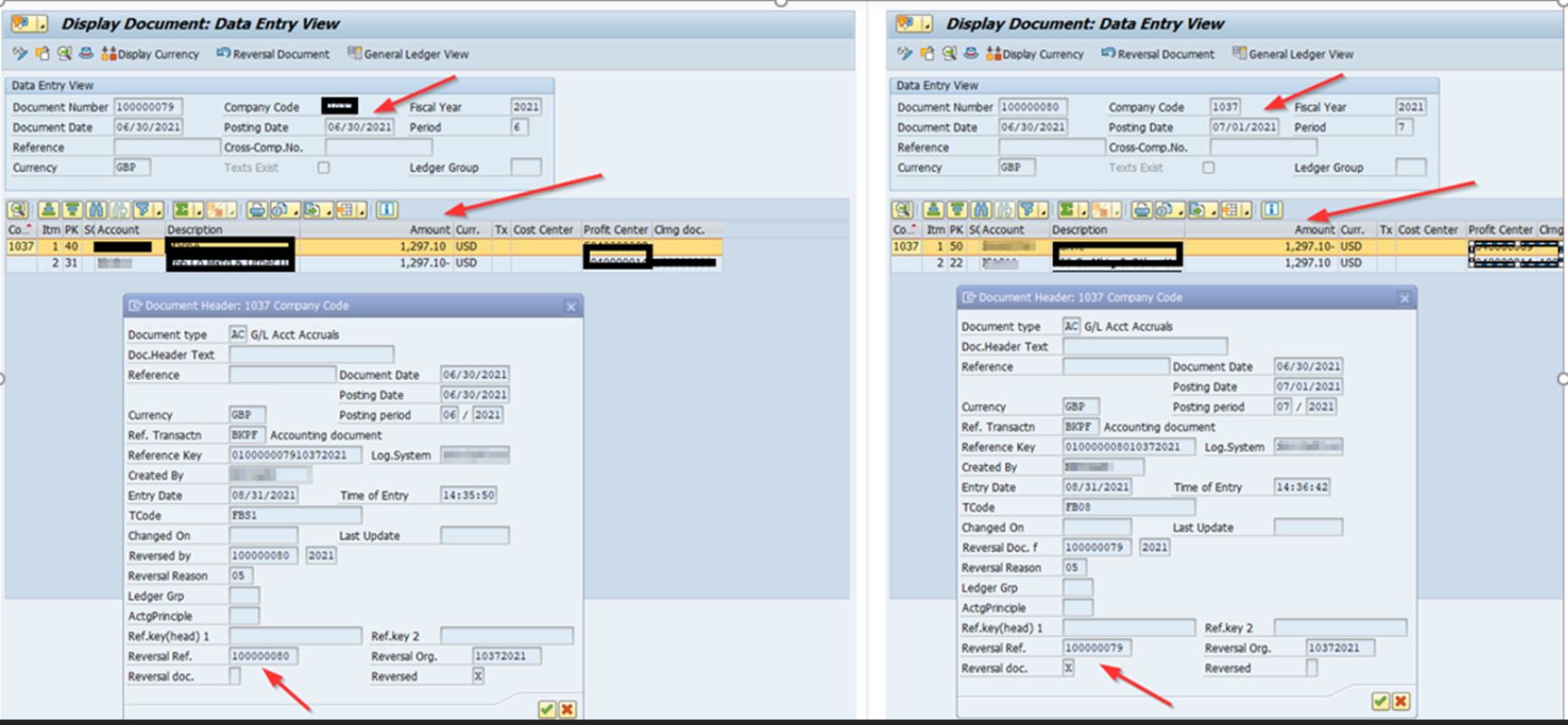

When a FI document is reversed with transaction FB08, the created reversal FI document has the same amounts in all currencies and in all line items as the original, reversed FI document has. In case of a reversal process no new currency translation with the posting date of the reversal posting is made, but instead all amounts are copied from the original, reversed FI document to the reversal FI document, and so are the exchange rates, too. A reversal with transaction FB08 is to completely 1:1 neutralize the original posting. Only in this case this is a real reversal.

Implications

- Auditors may flag inconsistencies between realized exchange rate gains/losses and the reversal postings.

- This creates discrepancies in the financial statements, particularly when reversals span across month-end or year-end periods.

- Lack of Transparency: The financial record does not reflect accurate exchange rate fluctuations. Auditors expect reversals to align with the current exchange rates for accurate reporting.

- Compliance Risks: Non-compliance with accounting standards (e.g., IFRS or US GAAP) could occur because financials do not properly recognize exchange rate variances.

Standard Accrual Reverse Process- FB08 – Different Months, Same Exchange Rate

This is a standard process

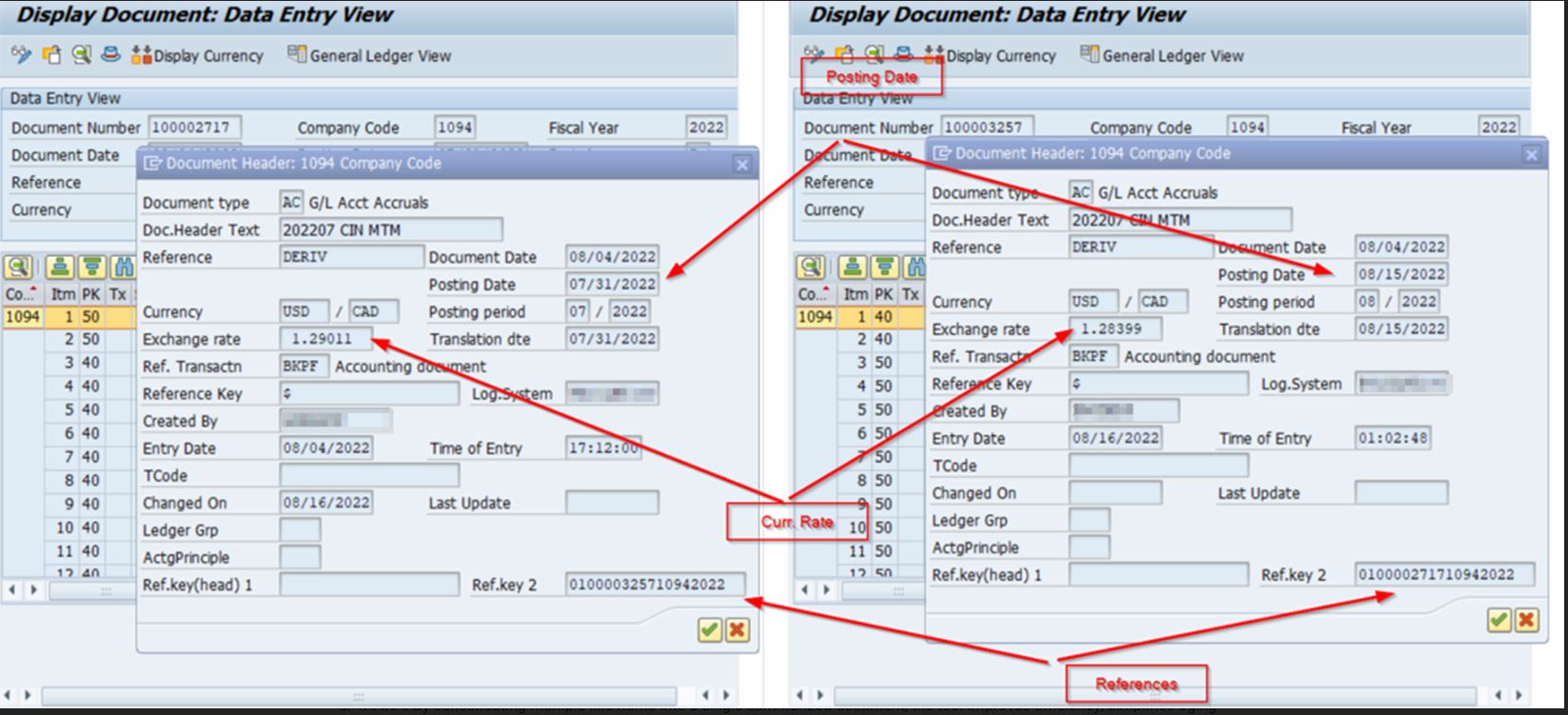

Our solution : Mirror Reverse – Different Months, Different Exchange Rate

Mirror reverse means a reversing document is created in the following period (e.g., November → December) where: Debits become Credits, Credits become Debits.

If there is a balance between inter company accounts, a separate program clears them.